Precious Metals

Precious Metals, such as gold and silver, have been used as mediums of exchange (money) for thousands of years.

As time progressed, these metals were fashioned into easily transportable coins of various sizes, often times issued by a sovereign. Many collectors have enjoyed the Roman coins of Christ’s period, because they are plentiful enough for the average collector to have a 2,000 year old piece of history for relatively few dollars.

It has been stated, by different financial guru’s, that one’s portfolio of investments should have 10-15% in Precious Metals. The big question is: “Where am I likely to get the best value?”

There are 3 principal motivators in the Precious Metals World which draw people to its unique space:

1. As a historical “store of value,” Precious Metal(s) related bullion coins, rounds, tokens, and bars have been a good hedge against the ravages of inflation.

Countries and their respective governments cannot help themselves. They all water down the value of their currency unit by printing fiat money: “fiat,” as in nothing of tangible value backing the currency… just a feeble promise of value – ever eroding by the effects of inflation, to which the over-printing of money inevitably leads.

So, Reason #1 is: “A store of value, where inflation has little detrimental effect on its buying power. Some would say, due to the fact that all the mining companies in the world cannot keep pace with the fiat printing of money by countries, it makes inflation the actual friend of net value increases to Precious Metals.”

2. The second motivation to buy items fashioned with Precious Metals(s), such as numismatics and jewelry, may be desirable.

In India, for example, gold and silver jewelry items are viewed as long-term investments, which the holder may frequently enjoy in the presence of others, often given as wedding gifts.

Likewise, rare coins (like jewelry) carry a market value which may exceed their “melt value” by several multiples.

Aesthetics are often associated with jewelry and Precious Metal Coin numismatic purchases, where an individual is “buying the story.” To get or make a profit on such purchases, however, one must find a motivated buyer, down the road, who is willing to pay a greater amount over “melt value” than the buyer before him.

Purchasing jewelry and/or numismatics involves a certain degree of emotion. “I’ve got to have that necklace or, say, that 1861 issued civil war era Southern Mint $5.00 gold piece (which is one of a hundred), where you fall in love with its beauty and history.

The problem with this type of purchase is the dealer markup. When their profit margin is “large,” your recovery time is “long”… Ergo, the point of profitability is way out into the future.

In my experience, the greatest dollar amount of dealer markup is not in the bullion coins, rounds, tokens, and bars, but in the collectibles.

The only time I can remember making any real profit, on my personal numismatics collection, was on a single coin I spent close to $40,000 to purchase.

So, Reason #2 is: “A long-term potential for profitability, while the present enjoyment of the item offsets the relatively higher markup associated with such items of lasting beauty or uniqueness.”

In India, for example, gold and silver jewelry items are viewed as long-term investments, which the holder may frequently enjoy in the presence of others, often given as wedding gifts.

Likewise, rare coins (like jewelry) carry a market value which may exceed their “melt value” by several multiples.

Aesthetics are often associated with jewelry and Precious Metal Coin numismatic purchases, where an individual is “buying the story.” To get or make a profit on such purchases, however, one must find a motivated buyer, down the road, who is willing to pay a greater amount over “melt value” than the buyer before him.

Purchasing jewelry and/or numismatics involves a certain degree of emotion. “I’ve got to have that necklace or, say, that 1861 issued civil war era Southern Mint $5.00 gold piece (which is one of a hundred), where you fall in love with its beauty and history.

The problem with this type of purchase is the dealer markup. When their profit margin is “large,” your recovery time is “long”… Ergo, the point of profitability is way out into the future.

In my experience, the greatest dollar amount of dealer markup is not in the bullion coins, rounds, tokens, and bars, but in the collectibles.

The only time I can remember making any real profit, on my personal numismatics collection, was on a single coin I spent close to $40,000 to purchase.

So, Reason #2 is: “A long-term potential for profitability, while the present enjoyment of the item offsets the relatively higher markup associated with such items of lasting beauty or uniqueness.”

3. The third motivation is as an alternative for commercial exchange in a global environment where:

A. …a single country has totally debased their currency; or,

B. …where the governments of the world rush to digital currency, recalling or declaring void their currency and coin in circulation.

“B” has never happened before yet today is a looming threat to one’s personal freedom – for a multitude of reasons.

First, Someone shall possess a digital diary of everything you shall buy and sell.

Second You can be shut off from commerce with the flip-of-a-switch.

Third If relegated to bartering with others, there’s no intermediary reference value to reduce the inefficiencies “barter” presents.

Say, you’re a dentist… and I’m a hog farmer. You crown my tooth… and I give you 25 prime sows. You only need one prime sow – what do we do?

Intermediary barter exchanges help, but there is always the “rake” the exchange takes on each transaction.

So, let’s say I have a one ounce gold Maple Leaf. I want to buy a couple loves of fresh bread baked by my neighbor. How shall my neighbor make change for what currently is a $2,000 coin?

If I own a 1/10th ounce gold coin or round, it’s still worth about $220.00 as of the publishing date of this article. More utilitarian than its one ounce Maple Leaf cousin, but still likely to require some form of change when buying daily items, such as vegetables, canned soup, firewood, you name it.

There exist smaller than 1/10th ounce gold coins but, quite frankly, they are so small that you cannot read the inscription and the chance of losing one of those little guys is highly likely.

Moving toward a currency-less digital environment shall increase demand for smaller bullion units, possibly of silver instead of gold.

One-tenth Troy ounce silver coins and rounds (non-government issued coinage look-a-likes) are the answer to commercial exchange, avoiding digital platforms.

US coins with silver content could be one approach to a medium of exchange, but the average person doesn’t know a 40% silver content US coin from a 90% silver content US coin.

Listen, I firmly believe that there is going to be a physical silver standard unit that becomes the ubiquitous de-facto medium of exchange, in the digital days ahead.

There are plenty of pure .999 silver rounds available for purchase today. The 1/10th Troy Ounce Rounds are really the perfect sized value unit, which shall dominate the untraditional new world non-digital commerce of the not-so-distant future.

Problem is: “Which one shall become the standard?” It may not matter, so purchase many types just in case. Presently, with silver trading at about $23.50 per ounce, you can source plenty of these rounds between $5.00 to $8.00 a piece.

Even if demand and silver prices double their cost/value, one still shall not likely need the “counter party of commerce” to provide change for a purchase.

What about government seizure?

Where it’s happened before in America, 1933 for gold and 1934 for silver, with criminal penalties for those who violated the recalls, there were exceptions made.

An individual was allowed to possess less-than-a-half-dozen $20.00 gold pieces under the 1933 order, and exemptions were made under the 1934 order for certain non-coin items made of silver.

Where it is unlikely that our government would do this again, since we left the Gold Standard and eliminated the “exchange of Silver Certificates for raw silver” in the summer of 1968, our country’s ability to grow its money supply is not inextricably linked to the amount of Precious Metal(s) our Treasury Department possesses.

Could it Happen? Sure, but I believe the odds are slim. But, then again, I never dreamed our individual rights would so scandalously be overrun by bureaucrats as rapidly as we’ve seen it happen!

In Conclusion:

Motivation #1: Buying Gold, Silver, and Precious Metal(s) coins, rounds, tokens, and bars, as a hedge against inflation, is still a sound move.

Motivation #2: Buying jewelry or numismatics, as an investment? Okay, but takes a long time to break even, unless you really want to drop some big bucks.

Motivation #3: Survival!!! What shall be the unit of exchange? A 1/10th ounce silver piece, providing excellent size (about that of a dime, yet, still able to read its inscription), portability and recognizability, shall rule the day.

7th Day Financial is here to assist you in meeting your Precious Metals needs… to the extent that we have or can reasonably source inventory.

Without being dramatic: Now is the time to prepare, before others make a “run” on supply.

When the average person figures something is amiss, it usually happens all at once – and the herd moves forcefully in one direction. Don’t wait!

Special Programs:

Let us market your Gold and Silver coinage and collectibles. We offer one of the lowest consignment premiums in the industry (normally charging only 15% of the premium we get you over “spot price”).

Ask about our “Surf and Turf” program, where Florida residents (or visitors) can access bullion coins at market “bid” prices without any mark-up on our end.*

Nobody, anywhere, offers anything similar to this.*

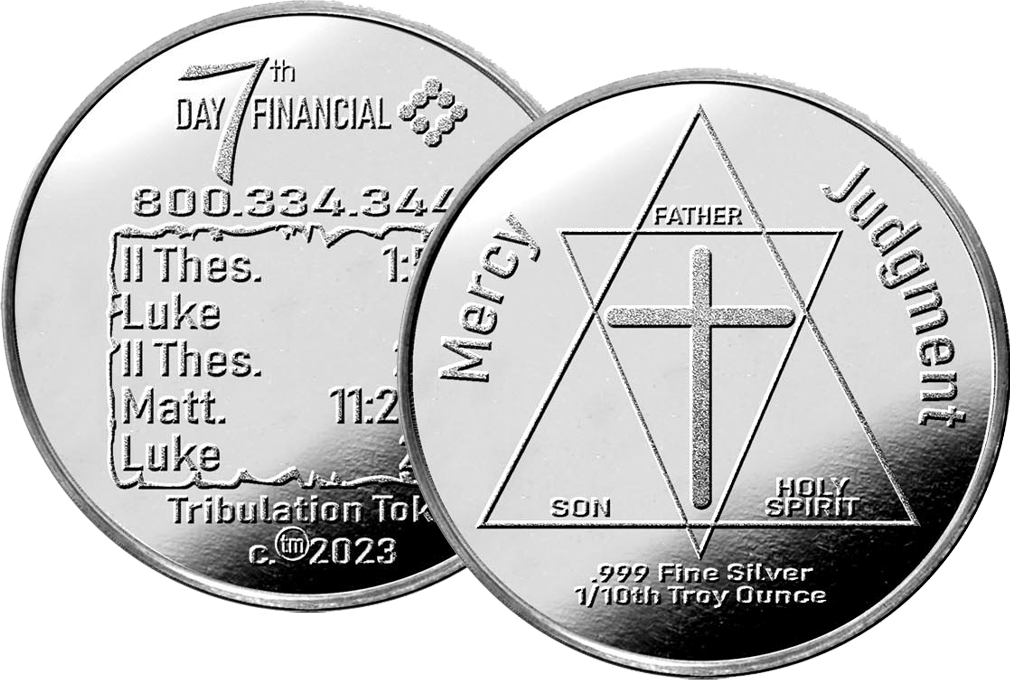

*Also eligible for “end-column pricing” on Tribulation Tokens.

12 Point Comparative Evaluation

Tribulation Tokens Versus Small Silver Coinage